SPAIN

Few tourism destinations in the world offer such a dazzling array of places to see and tourist attractions to visit as Spain. This European country is also filled with striking natural scenery and beauty, from the rugged Sierra Nevada mountain range to the white sand and blue lagoons of its Mediterranean islands like Ibiza.

The country is also fascinating due to the different cultures of its distinct regions. There is just so much history here, much of which can be explored in any single city. Many Spanish cities have ancient Roman ruins and Islamic architecture from the Moorish period, medieval castles and fortifications along with Castilian- and Hapsburg-era palaces and mansions. Most also feature many examples of modern Art Nouveau, Art Deco, and Modernist architecture.

The country also represents the pinnacle in all things related to the sheer enjoyment of life: delicious food; great art; amazing music; lively dances; and warm, friendly people. So, let’s explore some of the most exciting places in Spain.

Madrid

Spain's large capital city showcases the country's incredible history. It's a perfect holiday destination, as there are royal palaces, marching soldiers, changing of the guards, and hundreds of museums to visit.

No visit to Madrid is complete without visiting all three of the city's major museums. The Prado Museum (officially called the Museo Nacional del Prado) showcases what was formerly the Spanish royal collection of art, while the nearby Reina Sofia Museum shows modern masterpieces like Picasso's moving Guernica. Also, the nearby Thyssen-Bornemisza Museum combines Old Masters with the best in contemporary art.

Madrid is also a classic, European strolling city, filled with green spaces to enjoy like the Buen Retiro Park, as well as wide, pedestrian-only boulevards like the iconic Gran Via. The food culture also thrives here, from casual tapas tasting cuisine to cutting-edge, Michelin-starred molecular gastronomy.

La Latina, one of the city's oldest neighborhoods, has evolved into tapas-central with a plethora of tapas-serving establishments, most with outdoor terraces. It's fun to go from place to place sampling each one's specialties.

Despite the economic ravages wrought by the coronavirus pandemic, the property market in Madrid remains relatively dynamic and buoyant. The Spanish capital continues to be an appealing destination to expats for its culture, activities, infrastructure, parks, gardens, nightlife and relatively cheap cost of living for a major city. Foreigners have the right to buy and resell both commercial and residential property without limits. However, it's important to note that buying property doesn't come with the automatic right to live permanently in the country, and you'll be responsible for securing your visa. Mortgages are available to expats who are planning to live in Spain full time as well as for non-residents.

In Madrid, as in the majority of cities, the most common living options are a flat or apartment in a residential building, varying from tiny studios to luxury penthouses. Other options include duplexes and detached or semi-detached homes. Real estate prices in the capital are generally the most expensive in the country, with the district of Salamanca often topping lists of the most expensive areas to live in Spain.

The average cost of an apartment per square meter differs significantly by area. Apartments in central Madrid neighborhoods like Chamartín, Chamberí, Retiro, and Salamanca average around €4,967 per square meter, while the average price outside the center is €3,066 per square meter

Madrid Neighborhood Guide

Location is probably the most important determining factor when purchasing a home. No matter how much you like your apartment or house, if the area is unsuitable for your needs, your quality of life and the enjoyment of your home will suffer. The prospect of finding a home in the right neighborhood is daunting enough, but even more so when you're doing it in a foreign country. If you're new to Madrid, choosing a locale can be challenging, especially if you don't know it all that well. Picking the right area requires research, and everyone will have their preferences and ideas about what they want. Madrid has an abundance of choices for everyone, from young students wanting nightlife on their doorstep to families dreaming of a garden and pool.

One of the first decisions you'll have to make about living in Madrid is whether to find a home in and around the city center or in the suburbs. Both offer benefits and drawbacks. In the suburbs, prices are generally lower, and homes are larger. You're more likely to find a place with a garden and be nearer to the city's best international schools. However, you'll definitely need a car to get around. The city center puts you within easy reach of all the nightlife, culture and excitement Madrid has to offer. You can easily get around by public transport, but flats tend to be smaller, and rents can be much higher.

Atocha

This central neighborhood is the home of Madrid's main train station, Estación de Atocha. The area is approximately a 10-minute metro ride away from the heart of Madrid and is a popular choice for students because it's so well connected to the city's many universities. Atocha is known for its many shops, bars, restaurants and museums.

The main attractions include the Museo del Prado, Museo Arqueológico, Museo Thynssen-Bornemisza, Teatro Kapital and Parque del Buen Retiro. This beautiful and expansive green space is known as the Spanish Hyde Park and boasts a boating lake, rose garden, glass pavilion (Palacio de Cristal) and thousands of trees.

Chamberí

This pretty, elegant neighborhood is lauded for its beautiful architecture, stately historic mansions on wide avenues that are now home to some foreign embassies. It comprises several neighborhoods and for two centuries was where many aristocrats had their homes. This central district also hosts plenty of bars, restaurants and delightful plazas. The main attractions include the Museo Sorolla, the Abadia Theater, Cine Paz and Santander Park.

La Latina

This historic locale in downtown Madrid is one of the capital city's most traditional neighborhoods. The narrow streets are lined with tapas bars, restaurants, large plazas and old churches. One of the area's biggest draws is El Rastro, a weekly open-air flea market held every Sunday and on public holidays. La Latina rental prices are good, but the quality of homes can be hit or miss. The main attractions in addition to El Rastro include Teatro La Latino, Mercado de Cebada, San Andrés Church, and Cava Baja, the city's most famous street for tapas.

Malasaña

This hip, historic area is a stone's throw from the center of Madrid and is a trendy, bohemian place with a wide selection of chic boutiques, cafés and shops. At night Plaza del 2 de Mayo, a beautiful square in the heart of the neighborhood is the hub of the local nightlife. In recent years, the area has undergone gentrification, and consequently, rental prices have crept upwards. The main attractions include the Church of San Antonio de los Alemanes, the Baroque Church of San Martin and the History Museum. Inside are collections highlighting the customs, traditions and arts of Madrileños (people from Madrid).

Salamanca

One of Madrid's most upscale neighborhoods is located northeast of the historical center. It dates back to the 19th century and was designed to be an area exclusively for Madrid's aristocracy and bourgeoisie. Among today's residents are businesspeople, financial and political elites and diplomats. Within its boundaries are high-end shopping stores and Calle Ortega y Gasset, also known as the Golden Mile of fashion. The main attractions include Plaza de Felipe II and the Juan March Foundation, which hosts contemporary art exhibitions.

Retiro

This neighborhood lies just south of Salamanca, and east of the park from which it gets its name - El Parque del Buen Retiro, nicknamed "El Retiro" by the city's residents. This middle/upper-class locale is an excellent place for families with children. It's laidback, well-connected to the city center and features a wealth of bars, shops and restaurants. The main attractions include the Casa Arabe cultural center and the 18th-century Puerta de Alcalá Gate.

Popular Suburban Areas

Away from the central areas are delightful suburbs that attract more affordable rents and property prices than in the heart of Madrid.

La Moraleja

This is an attractive residential area in the north of Madrid. If you're looking for a new, detached home, this is the place for you. It's close to private schools with excellent reputations as well as upscale restaurants and shops.

Pozuelo

This is another affluent suburb and it's located northwest of Madrid's center. The area is popular with expat families because it boasts high-quality properties, is well connected to the downtown core by train and is home to several international companies. Among the other suburbs offering a good quality of life with excellent amenities, green spaces and public transport links to the center are Las Rozas and Majadahonda.

How Much Does It Cost To Rent a Property in Madrid?

Being the country's capital, rental prices are higher in Madrid than in many other places in the country. Prices vary according to the type and size of property, neighborhood and proximity to the center. To give an approximate idea, the average rental prices as of July 2021 were between €750 and €1,200 per month for a 1-bedroom apartment in the city center, and between €550 and €900 per month for a similar property outside of the center. A three-bedroom apartment in the city center will set you back around €1,300 and €2,200 per month, while the same property outside of the center will cost you between €900 and €1,500 per month.

How Much Does It Cost to Buy a Property in Madrid?

The property market in Madrid is dynamic, fast-moving and expected to grow in the coming years. Property prices are generally on the expensive side. As of July 2021, the average price per square meter to buy a city center apartment is €5,022 (ranging from €3,800 to €6,000). The average price per square meter for an apartment outside of the center is €3,063 (ranging from €2,500 to €4,500).

Barcelona

The second largest city in Spain offers a completely different travel experience compared to Madrid. Its coastal location gives it more of a resort feel, complete with warm, sunny weather to enjoy on most days of the year. It's on the country's northeast coast, by the Mediterranean Sea, and also seems to have a much more modern, progressive vibe than Madrid and other Spanish cities.

Must-see tourist attractions in Barcelona include the city's immense (and perpetually unfinished) Sagrada Familia modern cathedral and the Joan Miro museum, conceived by the iconic artist himself before his death. Other good places to see in Barcelona include the city's almost three miles of beaches and La Rambla, a huge, tree-lined, pedestrian-only street. It's where the entire city seems to come out for a stroll.

Continue to where La Rambla meets the water, and you'll find the Maremagnum shopping mall. It's on its own man-made island, almost completely surrounded by water. You get to it by walking over a very cool wooden drawbridge, called Rambla de Mar. It opens each hour to let sailboats and yachts pass through. Head to La Terraza, the mall's panoramic platform with 360-degree views of the water and city skyline. The city's large aquarium is next to the mall on the same little peninsula and is well worth a visit.

Be sure to take the funicular (incline railway) up to the summit of Tibidabo, a local mountain with a beautiful church and amusement park at the top. You'll also be rewarded with spectacular views of the city and surrounding countryside.

Barcelona Real Estate Market Overview

The Spanish property market made an excellent recovery in 2021 with property transaction figures across both the country as a whole and the province of Barcelona exceeding pre-pandemic levels.

The number of sales of new homes in the province of Barcelona in 2021 was up by 23.8% when compared to the sales of new homes in 2020, with INE registering the highest number of sales since 2011. When looking at used housing, the number of sales in 2021 increased by 31.9% compared to 2020 and returned to the pre-pandemic level of 2019.

The latest data from the Generalitat de Catalunya confirms positive trends. The number of sales in Barcelona city itself in 2021 increased by almost 40% when compared to the number of sales in 2020 and all of the city’s ten districts also registered increases. The highest rise was in the highly desirable and central district of Eixample where property sales transactions rose by almost 60%. This was followed by the upmarket area of Sarrià-Sant Gervasi where transactions rose by almost 50%.

– Ciutat Vella (Barcelona Old Town): 1,029 sales (42.72% increase)

– Eixample: 2,129 sales (59.95% increase)

– Sants-Montjuïc: 1,445 sales (25.98% increase)

– Les Corts: 612 sales (29.94% increase)

– Sarrià-Sant Gervasi: 1,174 sales (49.94% increase)

– Gràcia: 1,072 sales (30.89% increase)

– Horta-Guinardó: 1,522 sales (37.36% increase)

– Nou Barris: 1,345 sales (55.13% increase)

– Sant Andreu: 1,287 sales (17.00% increase)

– Sant Martí: 2,071 sales (44.83% increase)

Even though the number of transactions is rising significantly, average property prices in Barcelona city are still holding fairly steady and in some districts decreases are still being registered. At the end of February 2022, prices across the city as a whole showed an annual decrease of 1.4%, according to leading property portal Ideliasta, with the average price per square meter ending the month at €3,929. Four of the city’s ten districts registered an annual increase at the end of February: Eixample, Gràcia, Sant Martí and Sarrià-Sant Gervasi. It is uncertain as to how long it will be before prices start to rise to reflect the increase in sales transactions, but it does suggest that there are still many excellent opportunities to be found.

– Ciutat Vella (Barcelona Old Town): €3.988 per square meter (4.9% decrease)

– Eixample: €4.594 per square metre (2.8% increase)

– Sants-Montjuïc: €3.378 per square metre (1.5% decrease)

– Les Corts: €4.923 per square meter (0.0% change)

– Sarrià-Sant Gervasi: €5.240 per square metre (0.5% increase)

– Gràcia: €4.278 per square metre (3.5% increase)

– Horta Guinardó: €3.014 per square metre (1.8% decrease)

– Nou Barris: €2.353 per square meter (5.5% decrease)

– Sant Andreu: €3.073 per square metre (1.8% decrease)

– Sant Martí: €3.559 per square meter (1.0% increase)

Foreign Buyers

Barcelona remains an extremely attractive option for foreign property buyers. Although the proportion of buyers from outside Spain acquiring property in the province of Barcelona in the last quarter of 2021 decreased very slightly when compared to the last quarter of 2020, it has in fact remained fairly steady in the last few years despite both Brexit and the Covid-19 pandemic: Q4 2018 (8.7%), Q4 2019 (9.5%), Q4 2020 (9.0%) and Q4 2021 (8.67%). This is a much higher proportion than in Madrid: Q4 2018 (5.8%), Q4 2019 (5.8%), Q4 2020 (4.9%) and Q4 2021 (4.53%).

Valencia

Valencia is a port city with a long connection to the sea and to Spain's trade with the world, especially with Europe, the Middle East, and Africa. It's on the Mediterranean Sea, on the country's southeastern coast. As a coastal city, there are some nice beaches to enjoy. Another outdoor place to see is Albufera Park, a beachside wetlands reserve with a lot of hiking trails.

The city has many museums. A highlight is the Museum of Fine Arts (Museu de Belle Arts de Valencia), with its excellent collection of Spanish masters by artists like El Greco and Goya. There's also a large, Gothic-style cathedral in the medieval center of the old city along with remnants of the old city walls.

Be sure to visit the Torres de Serranos, one of the only standing gates to the walled city and a prison for over 300 years. The National Museum of Ceramics and Decorative Arts, "González Martí," is filled with cool stuff. Spanish decorative arts is the focus here, with an incredible collection of ceramics, traditional costumes, and furniture. Kids will love the Natural Science Museum and its large collection of dinosaur skeletons.

When you get hungry, head to the city's Mercado Central, a vast Art Nouveau-style market hall (built in 1914) filled with food vendors and cafés (along with souvenir shops and other tourist-type businesses). Although it's a popular tourist attraction, you'll be surrounded by locals, too, as it's where they go to eat and hang out.

Valencia Real Estate Market Overview

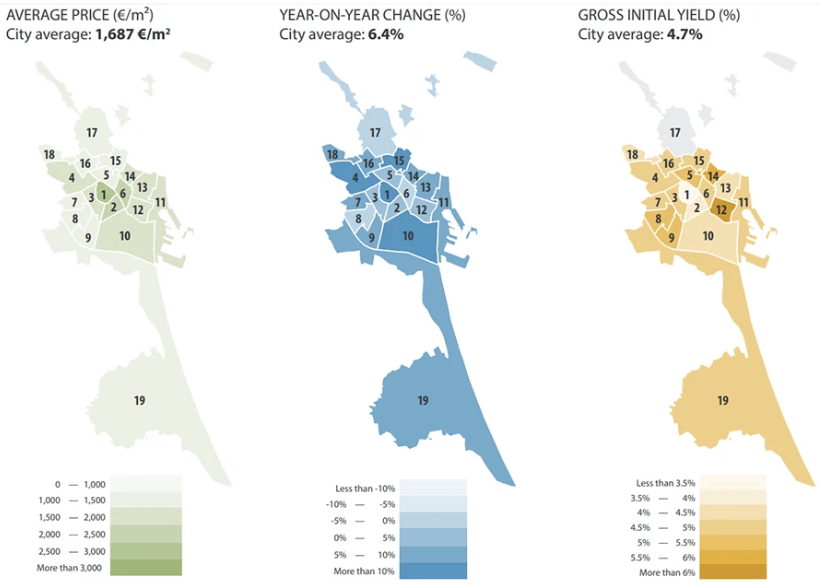

In the Valencia region, the increase in the average selling price was 5%. A good average if you look at the other regions in Spain. A remarkable development took place in Valencia city. From year to year, there was a fluctuation of more than 10% in the four districts of Campanar, Quatre Carreres, Ciutat Vella and Rascaña. Ciutat Vella, L’ Eixample and Pla del Real are in the top positions with more than 2,000 euros per sq.m. In comparison, the average price per sq.m. in the first quarter of 2022 was 1,214 euros in the rest of the Valencia region.

House prices in the region and Valencia city are still interesting for foreign buyers looking for a good return on their investment. The average for Valencia city is:

Price: €1,687 per m2

Price increase: 6.4%

Gross rental yield: 4.7%

With an average return of 4.7%, Valencia City still leads the way among the three largest Spanish cities; in Barcelona the average is 4.1% and in Madrid 4.4%.

The map below shows in green: the average price per square meter per quarter, in blue: the average price increase year on year per quarter and in yellow: the gross rental yield per quarter.

A table shows again where the aforementioned price increase is in the districts in Valencia city: 11.4% in Ciutat Vella, 12% in Campanar, 11.4% in Quatre Carreres and 11.1% in Rascaña. These districts are therefore becoming increasingly popular with investors.

Ibiza

One of the best vacation spots in Spain for couples is the resort island of Ibiza located about 100 miles off the Spanish coast. Ibiza is the largest of the Balearic Islands, a group of mainly resort islands in the Mediterranean Sea. The other three largest islands, Mallorca, Menorca, and Formentera are also popular places to see in Spain.

Ibiza may be best known for electronic music, beach parties, and massive dance clubs, but it's also filled with a lot of great family resorts and lots of fun things to see and do with kids. It has something for everyone and is a good destination for singles, couples, and families. Resort areas in Ibiza include Portinatx in the north, San Antonio in the west, and Santa Eulalia in the east.

Ibiza Real Estate Market Overview

In general, buying property has always been a reliable investment. Of course, it does involve numerous factors and variables. But, one thing is for sure, you’ll certainly have a better chance of getting a decent return if you buy a property in a location that’s highly valuable and sought-after.

Ibiza has been a safe choice for property investment for quite some time now, mostly because of its idyllic location and its ongoing high demand for properties. Whether you are looking to buy a second home, a villa for tourism rental purposes, or you are interested in your own renovation or an early project phase property – as the current market stands, purchasing a home in Ibiza will make for a secure future return of investment.

Over the past decade, both sales and house prices have shown continual and stable growth across the Balearic Islands. It was not until late 2019 and into early 2020 that house prices and sales started to fall for the very first time since the start of the financial crisis in 2007. This suggested the beginning of a minor stagnation that later increased due to the circumstances of COVID-19.

However, from early 2020 through to the end of 2021, buyer activity quickly thrived again, with property sales continuing to rise across the whole of the Balearics. It was more than evident in Ibiza that a surge of numbers and growth in the second-home international real estate market was occurring. People’s priorities were changing due to COVID-19, and living among beauty and nature, away from the big cities became increasingly more appealing. The high-end property market in Ibiza continues to be a magnet for second-home buyers. After the initial sales spike of 2021, things have marginally slowed down as the post-pandemic effect has worn off, but the fact remains that demand for properties still continues to far exceed the number of sellers on the market, thus resulting in a strong and unwavering price curve.

Buying a Property in Ibiza with a Touristic Rental License

In Ibiza, there are many people who wish to buy a villa to rent out for tourism purposes. Despite this, it is not as simple as many would believe. Not every property in Ibiza can legally be rented out to tourists for short-term holidays. Those who wish to proceed with renting their property will need a final tourist license. And, any application for a tourist license must satisfy a strong set of requirements.

Buying an Authentic Property in Ibiza for a Renovation Project

It is becoming more and more difficult to find older, authentic properties now in Ibiza that can be renovated and re-sold with good returns on investment. A few years back, this was a great option with many more properties readily available. Now, it is becoming harder to find this type of property with the potential to create a modern boutique-style home and gain a decent return. But, of course, it is still possible if you employ the support and expertise of a good estate agent who knows the market well and can advise the right construction teams to employ for such projects.

Buying a Property in Ibiza During ‘Off-Plan’ or During the ‘Project Phase’

There is also the option of purchasing a property off-plan or when the project is still in the development phase, where you then would continue to build the home yourself. If you have time, patience, and passion on your side, there is a good chance that you can save quite a bit of money too, making for a great investment opportunity. Further, this kind of property can also be resold with a bit of a profit margin, or leased on a long-term basis, excluding short-term holiday rentals. As we previously mentioned, obtaining a tourism license encounters a strong set of requirements, and new build properties must wait 5 years before they can apply for tourist rental licenses, and it can still prove challenging even after that.

Buying a Property in Ibiza for Investment

Ibiza in general is a very good market to invest in, being stable and safe, especially for long-term investment and ongoing increase in property value. There are often some really great investment opportunities here. But as the demand is almost always higher than the supply, if the perfect investment property is not already on the market, then actively registering yourself with the right agent as early as possible comes highly recommended. This way, as soon as the right investment opportunity property becomes available that is suited to your personal requirements, you’re ready to get the process started as soon as possible.

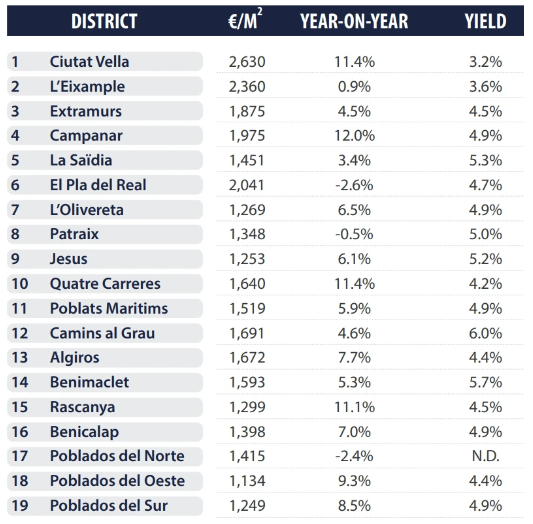

Average Price & Price per sq.m. by Municipality

On the whole, all areas on the island have experienced price-per-square-meter increases between 2019 and 2021.

Eivissa – Average Price & Price per sq.m. by %

The entire city is in high demand and continues to demonstrate a strong market presence. Overall, Eivissa has something for everyone, like most cities in Europe, and has increased in popularity in line with the rest of the island. Eivissa has experienced a 15% increase in price per square meter since 2019.

Average Property Size: 168m2 | Average Property Price in Euros: 1.3M

Sant Josep – Average Price & Price per sq.m. by %

San José has always been high in demand among affluent luxury second-home buyers. In 2021, if we segmented San José, areas such as Es Cubells and Ses Salines would still naturally appear at the very top of the island property portfolio, where many other San José developments and properties would now be on par with some of the properties and prices on offer in Santa Eulalia. Sant Josep has experienced an 18% increase in price per square meter since 2019.

Average Property Size: 256m2 | Average Property Price in Euros: 2M

Santa Eulalia – Average Price & Price per sq.m. by %

In 2021, a particularly large property sale occurred in Santa Eulalia, leading to an unusual rise in the overall average price per square meter and as previously mentioned, some flexibility is required here. However, if we take the current average as gospel, Santa Eulalia would have experienced a 48% increase in price per square meter since 2019. It is clear that Santa Eulalia (despite margin for slight error) is catching up rapidly to the highly sought-after area of San José.

Average Property Size: 311m2 | Average Property Price in Euros: 3.5M

Sant Antoni – Average Price & Price per sq.m. by %

The area of San Antonio de Portmany is slowly making progress, becoming more sought-after than clients may first assume. Although the area is often in less demand than other areas, potential home buyers are often encouraged to look at the abundance of opportunities and great investment prospects here. San Antonio has seen a 12% increase in price per square meter since 2019.

Average Property Size: 299m2 | Average Property Price in Euros: 1.6M

San Juan – Average Price & Price per m2 by %

In the last couple of years, Sant Joan seems to be where the most prestigious and expensive villas are located, with a price tag that has almost doubled on average over the past few years. The new demand for properties in the municipality is a reflection of the property market’s high-end price valuation. San Juan has seen a 6% increase in price per square meter since 2019.

Average Property Size: 344m2 | Average Property Price in Euros: 3.7M

The market in Ibiza has exhibited different behavior depending on the segment. However, the demand for detached homes for sale or long-term rental has increased. There have also been price increases, more notable in detached homes than in new developments. Thus, standard multi-family homes sit between 3,000 and 4,000 €/sq.m., with a surface area from 50 sq.m. to 140 sq.m., with one to three bedrooms. Single-family homes typically register between 6,000 and 7,000 €/sq.m. and those larger family homes value between €10,000 and €20,000/sq.m. These properties were mostly located on the seafront promenade of Ibiza or on the front line of a marina. The most expensive single-family home registered between 12,000 and 15,000 €/sq.m. for a detached house. This unit was mostly located on the west coast of the island of Ibiza in the municipality of Sant Josep and around Ibiza in the neighboring municipality of Santa Eulalia.

Covid-19 Effect on the Property Market in Spain

Strong demand is reviving Spain’s residential market

Over the course of 2021, in the wake of the pandemic, a misalignment has emerged in the real estate sector between a demand that has recovered very quickly and a supply that is more dependent on structural factors and therefore continues to lag behind. As a result of this misalignment, house prices have started an upward trend which may continue to some extent in the coming quarters as a result of higher production costs in the sector and problems with the supply of certain raw materials. Nevertheless, in the medium term, as new supply enters the market and tensions in global supply chains ease, prices should return to a growth rate that is more in line with the trend in household income.

Demand for housing was one of the most positive surprises of 2021

After the historic shock of the pandemic, the situation of the Spanish economy improved notably throughout 2021. The progress made with vaccinations and the effectiveness of the measures implemented to mitigate the economic and social impact of COVID-19 have enabled activity to recover progressively. This positive trend is expected to improve further in 2022, thanks in part to an additional boost from the NGEU funds. The forecasts, therefore, predict that Spain’s GDP will accelerate, growing by 4.4% in 2021 and 5.9% in 2022.

Within this context of economic recovery, Spain’s real estate market is posting a very positive trend, especially in terms of demand. So much so that the revival in house sales is surprisingly vigorous: 468,000 transactions were completed by October 2021, a growth of 35.9% compared to 2020 and up by 8.3% in 2019. In fact, activity in the residential sector is at its highest level since 2008. A large part of this revival in demand has come from a reduction in pent-up demand and the «forced» savings accumulated during the months of lockdown and severely restricted travel, combined with highly favorable financing conditions, which make it more attractive to buy and invest in real estate assets. The residential sector therefore closed 2021 with 545,000 sales in the year as a whole.

Across the autonomous communities, the regions that have yet to regain their level of business in 2019 are those whose economies have suffered most from the consequences of the health crisis. This is particularly the case of the Canary Islands and Balearic Islands as they depend most on the arrival of tourists, where the number of house sales in 2021 was more than 5% below pre-pandemic levels. The Community of Valencia and Basque Country are the other two regions where residential demand is particularly sluggish as they were markedly affected by the severe restrictions resulting from Covid-19 due to their dependence on foreign demand (in the case of the former) and the sectoral composition of the region’s economy (in the case of the Basque Country).

Demand Is Surprisingly Strong But Post-Lockdown Trends Are Already Beginning To Moderate

As the sector evolves towards the new normal, we are starting to see that some of the main features characterizing post-lockdown demand are easing:

- not only is there a recovery in the purchase of new builds but used house sales are also growing and are above pre-COVID levels;

- the preference for living outside large cities or provincial capitals is moderating (the rise in teleworking and a search for greater social distance led to interest in housing outside large urban centers);

- the number of the dwellings purchased, after increasing significantly in 2020, seems to have stagnated in Q1 2021;

- the sale of single-family homes (as a percentage of total sales) peaked at the end of 2020

- foreign demand started recovering significantly towards the end of 2021 in comparison with the summer of 2021 when the success of the vaccination campaigns in Spain and throughout Europe allowed for a drastic reduction in restrictions on travel with a consequent increase in tourist arrivals.

Property Market Trends and What To Expect in 2022

2021 was marked by a general recovery process, greater mobility between countries, an increase in house sales, the attraction of international investors and a steady decline in rental prices. What will happen in 2022?

The housing sector is still dependent on the overall economy and the spread of the coronavirus. According to the analytical company Observatorio Sectorial DBK de Informa, in the short and medium-term, the real estate market has favorable outlooks to improve economic conditions, low-interest rates and growing savings. This means that we can expect a revival in demand and stabilization of prices for apartments in Spain in 2022.

The purchase and sale of housing in Spain reached a level in September 2021 that has not been observed in the last 13 years. According to the National Institute of Statistics (INE), the real estate market recorded the best month since April 2008 (53,410 transactions). Purchase intentions, paralyzed by pandemics, are being realized now to create new demand. Over the past 4 years, house sales have exceeded 2019 indicators. More than 53,000 transactions were concluded in September, which is 40.6% more than a year earlier.

The latest Spanish Property Price Index (the Tinsa IMIE) for the first quarter of 2022 finds that house prices rose by 6.6% compared to the same period in 2021. In quarterly terms, the increase is 2.3%. Just 7 of the total 52 provinces in Spain saw price drops in Q1 this year and all were below 2%. At the other end of the scale, 14 saw property values go up by over 7%. They included Madrid, the Balearics and the Costa del Sol. The Index highlights the trio for their sustained upward trend. Madrid stands at the top of the leaderboard for price hikes when it comes to autonomous regions in Spain. Real estate values in the region went up by 11.3% between January and March. The Balearics and Andalusia didn’t quite make double-figure increases, but both still ranked near the top. The property went up by 8.4% on the islands of Mallorca, Menorca and Ibiza, and by 7.7% in Andalusia, home to the Costa del Sol. The latest uptick brought the average square meter price on the Costa del Sol to €1,816. The figure now stands at 28.9% below the peak price reached in Q1 2008.

Buying Property in Spain As a Foreigner

Spain is an extremely popular destination for expats looking for a pleasant climate, high standard of living and of course, delicious food. Whether you’re thinking of working in one of Spain’s major cities such as Madrid, Barcelona or Valencia, or retiring to the Spanish coast, you’ll need to find somewhere to live.

While renting in Spain is definitely an option, many foreigners choose to buy property if they’re going to stay in the long term. Over 75% of people own their homes in Spain, and the large expat communities scattered throughout the country means that a high proportion of real estate is already foreign owned.

Traditionally, Brits have been the largest single group of expats investing in Spanish property, and this has continued even in the wake of Brexit-related changes. In fact, around 13% of foreign-owned homes in Spain were in British hands in 2020.

How Easy is Buying Property in Spain for Foreigners?

There are no special requirements or paperwork for foreigners wishing to buy property in Spain, so you shouldn’t have any issues. In fact, foreign investment in Spanish property was traditionally encouraged by the government.

All you need is a financial number (NIE), which you can get by popping into a Spanish police station and presenting your passport. However, for non-EU citizens it can take a few weeks to get this number.

There’s even a special Golden Visa scheme for foreigners. Through this program, you can get a residency visa if you buy a Spanish property worth more than £500,000. All the details about this program will also be explained further in this summary.

How Much Does It Cost to Buy Property in Spain?

If you’re thinking of buying a property in Spain, the price you pay will be influenced significantly by where you want to live.

Some of the most expensive properties in the country can be found in Barcelona, with Madrid city center prices falling a shade below this. However, if you want to live in the capital on a budget, you can decrease your housing costs considerably by looking to the suburbs instead of the city center.

In other areas of the country, such as the coastal regions, the wide variety of different housing on offer means you can find something to fit pretty much any budget.

Let’s take a look at roughly how much buying property in Spain costs per square meter, in different parts of the country:

How Can I Find a Property in Spain?

1. Property agencies and agents

There are several avenues you can take to find a property in Spain:

- Through an estate agent (inmobiliaria)

- An online portal which puts owners directly in touch with prospective buyers

- Word of mouth, or via adverts in the neighborhood you’re interested in.

An estate agent, if used, generally works on behalf of the seller. The estate agent fees are likely to be around 3% of the price of the property, and are usually paid by the seller.

If it’s the first time you’ve bought a property in Spain, then a specialist buying agent or broker might offer helpful advice and insight into the local market. However, there will usually be a fee to pay for this service, and you should make sure you’re clear on what you’ll get for your money, as both the packages and prices can vary considerably.

2. Property websites in Spain

The best way to get a head start on finding a place to buy in Spain is to look online. Great websites to find a house or apartment to buy include:

- Idealista has ads in English, French, German and several other major languages, as well as a handy search function which allows you to select the property features that are most important to you (https://www.idealista.com/en/)

- Fotocasa.es is one of the most-visited websites for property searches in Spain, and has listings in multiple languages (https://www.fotocasa.es/en/)

- Servihabitat has an English language website, with a map function allowing you to easily choose where you want to look for your new home (https://www.servihabitat.com/en/)

Pitfalls of Buying Property in Spain

One of the main things to watch out for when buying property in Spain, or in any foreign country, are scams. To avoid scams and other pitfalls, make sure to get local advice and recommendations for a broker. You should also check for membership of a professional body when working with any property experts, brokers or agents.

The API (Agente de la Propiedad Inmobiliaria) is an association of Spanish realtors, which works in regional chapters based across Spain. Choosing an agent in your local area who holds this membership should make sure you don’t fall foul of any scammers.

Other important things to remember include:

- Be cautious and do your homework (including meeting or speaking to the seller) before sending money or a deposit.

- Ensure that the seller has the legal right to sell the property.

- Get an inspection/survey carried out if you have any concerns about the property.

How Do I Choose the Right Property?

Property types

Spain has a well developed real estate sector. This means you'll have a wide choice of apartments, houses or even land if you want to build your dream home yourself.

Naturally, you'll find more flats available in built up areas and cities, with houses and villas more readily available in newer developments in the suburbs, and in towns and villages.

You'll find a good mix of older properties and new build condos in the cities, while the coastal towns - popular with those looking to retire in Spain in particular - also have a good mix of new apartment complexes and villas, and more traditional style homes once you move slightly away from the seafront.

Condition of the property

It’s a smart idea, though not required by law, to get a survey done on any property you choose before you commit to buying it. This isn’t actually the norm in Spain but some houses, in particular those over about 15 years old, can have hidden problems which are costly to fix.

Construction standards in Spain have improved greatly over recent years, and new builds are erected to the same standard as anywhere else in Europe or North America. Older homes, however, may not have been built to quite the same meticulous standard. To double check this you can find a surveyor online, or ask for recommendations from local connections.

How to Buy Property in Spain - a Step-by-Step Guide

- Choose where to buy. You can do some research online, but it usually helps to take a trip to Spain to get a feel for the area and view properties in person.

- Find an estate agent, if you’re planning to use one.

- Get your finances in order. It can be a good idea to get an offer in principle from a mortgage provider before starting your property search.

- Carry out viewings and choose your dream property.

- Make an offer through the seller’s estate agent. You can negotiate, just like in other countries. Once an agreement is reached, a notary can summarize the offer in writing.

- Consider arranging a survey. It isn’t mandatory, but a house survey could help to flag up any serious issues.

- Once the offer is accepted, you and the seller will sign a preliminary contract (contrato privado de compravento) and you’ll pay a deposit - usually 10% of the purchase price.

- Find a property lawyer. It’s important to have all documents checked over by a registered legal professional, who will also register the property and carry out due diligence on the transaction.

- Sign the contract of sale (escritura de compravento).

What Are the Legal Requirements to Buying a Property in Spain?

The notary has an extremely important role in house sales in Spain. They will prepare the contracts and make sure that they comply with local laws. However, you’ll also need your own property lawyer to help with other aspects of the sale, such as ensuring the person proposing the sale is actually the legal owner of the property, and that there are no existing debts listed against the property. This is especially important in Spain, as debts are attached to the property and transferred with the ownership. If there’s an outstanding mortgage on the place in the previous owner’s name, you could find yourself liable for it if you don’t check this properly. When choosing a lawyer, make sure they are registered with the local bar association (Colegio de Abogados).

What Kind of Taxes and Fees Will I Need to Pay?

All property purchases come with extra costs attached, so it’s important to factor these fees and taxes into your overall budget:

- Property transfer tax: 6-10% of the purchase price

- Notary fees, land registration fee and title deed tax: 1-2.5%

- Legal fees: 1-2%

- Estate agents fees: Usually paid by the seller, and typically around 3% of the price.

Spain Golden Visa

The Spain Golden visa, also known as the Spanish residency-by-investment program or the Spain investor visa, was created by the Spanish government in 2013 to attract foreign investors from outside the European Union to invest in the country’s economic growth. Investors and their families who meet the program’s criteria and invest at least €500,000 in real estate, a business enterprise, government bonds, or make a bank deposit will be given a simple and convenient way to receive a Spanish resident permit.

The fact that the government law does not require a minimum period of residency is a major benefit of the Spain Golden Visa program. An initial resident card is issued for one year (or two years if visiting Spain), after which it can be extended every five years for another five years. Permanent residency may be applied for after five years of continuous residency in the country. Please keep in mind that applicants will be asked to collect their biometric data in Spain.

Although it is not mandatory to live in Spain to obtain and renew a residency visa permit, the investor or eligible family members must spend at least six months per year in Spain for 10 years to qualify for citizenship. In addition, investors must visit Spain twice a year, with a gap of no more than five and a half to six months between visits. Eligible investors and/or their families will then be able to apply for Spanish citizenship. Some nationalities, such as people from former Spanish colonies, can qualify for a shorter period of full-time residency to apply for citizenship. Over 70 million people from the Americas can potentially claim Spanish citizenship in only one or two years.

Why Should You Apply for the Spain Golden Visa?

Spain’s Golden Visa program, similar to Portugal’s, has proven especially successful with applicants from China, Russia, Venezuela, Ecuador, Brazil and India. Between January and June of 2021, 848 applications for residency were accepted. What’s the secret to the program’s success? It’s because it’s easy. The visa application process is well-known for its pace and transparency, and applicants can take advantage of many main Golden Visa benefits.

Here are the Spain Golden Visa program benefits:

1) Fast processing times: The Spanish resident permit can be obtained within 60 days of the Golden Visa application being submitted.

2) No need for a visa: Since Spain is a member of the European Union, you can receive a Golden Visa and fly visa-free to any of the Schengen Area’s 26 countries.

3) European Union rights: You can live, work and study in Spain if you obtain a Spanish resident permit.

4) Residency arrangements for the family: Resident permits are guaranteed for the spouse and children under the age of 18. Other members of your family can even apply for citizenship if you have documentation proving they are your legitimate dependents.

5) Assurance of family safety: In times of economic or political uncertainty, having a backup plan puts your mind at ease.

6) Renewal is easy: The temporary residency permit is easy to renew, and you only need to visit Spain once a year to keep it valid.

7) It is not a donation-based program: It is an investment-only program with several different investment choices, so no donation is needed.

Many people dream of getting a Spanish passport because it helps them to fly visa-free to 187 destinations and gives them the freedom to study, work and reside in an EU member-state.

Investors may apply for permanent residency after five years of living in Spain. Citizenship in Spain can be acquired after 10 years, but applicants must have lived in Spain for at least six months per year during that period. Applicants are free to recoup their investment once they have either permanent residency or citizenship, as Golden Visa renewals are no longer needed.

Who is Eligible for the Spain Golden Visa Program?

Any non-EU, non-EEA, or non-Swiss resident who makes a qualifying financial investment in Spain, as well as their dependent family members, is eligible for a Golden Visa and citizenship in Spain. The Spanish Golden Visa program has established itself as one of Europe’s most successful residency-by-investment options. In comparison to other EU investment immigration programs, obtaining a Golden Visa in Spain is easy, straightforward, fast and inexpensive.

Requirements of Spain Golden Visa Program

If you or your family decide to remain in Spain for five years, you will be considered for permanent residency. You must, however, show that you have not spent more than 11 months outside of Spain in the previous five years.

Here are the Spain Golden Visa program requirements:

- The applicant must be over the age of 18.

- A clean criminal record is required of the applicant.

- The applicant cannot be on the government’s list of undesirables.

- A valid medical insurance policy and an official health certificate are required of the applicant.

- The applicant must not have been denied visas or admission into the Schengen Area in the past.

- The applicant must be able to afford to live in Spain.

- The applicant must make a qualifying financial investment (as specified in this guide) and provide evidence of the investment.

Who Qualifies as a Dependent in this Program?

You can submit an application for Golden Visa Spain family members at the same time as your application. The following people are considered dependents:

- Your spouse

- Minor children under the age of 18

- Family members who are financially dependent on you (upon financial proof that they are dependent or have a health condition that makes them unable to provide for themselves).

Possible Investment Options for the Spain Golden Visa Program

The Spain Golden Visa program allows for flexible real estate or capital investment.

1) Real estate: Invest in real estate worth at least €500,000. You have the option of investing in several properties.

2) Deposit in a bank: Make a deposit of at least €1,000,000.

3) Investment: Invest €1,000,000 in Spanish company stock.

4) Government bonds: Make a €2,000,000 contribution in government bonds.

5) Business investment: Establish a company in Spain that creates jobs, advances technical and/or scientific advancement, or has a significant socioeconomic effect.

Most investors choose to invest in real estate in Spain because it offers convenient access to the EU while also providing a residential home in the country for investors and their families to enjoy. You must continue your investment for a minimum of five years to keep your resident permit.

Tax Benefits of Spain Golden Visa Program

Investors will only be taxed on their worldwide earnings if they spend more than 183 days in Spain each year. Non-residents are taxed at a rate of 24.75% on income earned in the country, such as rental income. Expenses can help to minimize this. Any benefit gained from the selling of a property is subject to capital gains tax (CGT). CGT is charged at a rate of 24%, increasing to 27% for gains of more than €50,000. There are some allowances and deductions that can be made. The local authority collects annual property taxes, which range from €200 to €400 a year for an apartment.

The Spain Golden Visa Program Application Procedure

You will automatically obtain a one-year multiple-entry Spanish Golden visa after buying property worth at least €500,000. If the investor’s investment is still in place after a year, you must travel to Spain in person to apply for a two-year resident permit. Although you do not have to live in Spain to keep your resident permit, you must visit the country every year to renew it in person and to keep your investment.

Spain Residency-By-Investment Application Process:

- Decide your investment type

It is up to you whether you want to invest in real estate or make a capital investment. It is your decision.

- Invest according to the requirements

Translate all documents into Spanish or English and legalize them according to Spanish government guidelines.

- Prepare your documents

- Property registry filing (certificate) or notarized deeds with evidence of filing with the property registry

- All other documents are listed further down

- Notarize and translate documents

- Submit the application

You must pay the government application fee and submit all necessary paperwork.

- Schedule an interview

- Biometric collections session in Spain

- Keep an eye out for final approval.

Pay the government permit issue fee once your Golden Visa has been approved.

- Open a bank account and get NIE (Foreigner’s Identification Number/Tax Identification Number)

It is easier to conduct business and personal affairs in Spain if you have a bank account and an NIE.

- Get your residency certificate (one year)

You can renew your residency certificate at the end of the second year. You will become a permanent citizen in the fifth year.

- Apply for citizenship

You will be able to get citizenship after 10 years in Spain.

Required Documents for the Spain Golden Visa Program

Golden Visa applicants must request the following documents for both the initial application and each renewal. It’s possible that additional documentation would be needed. For more details, contact the Spanish Consulate or Embassy in your region.

Common Documents:

- Original passport of at least one year’s validity and two blank visa pages.

- Two passport-size photos with a white background are needed.

- Proof of valid medical care: public health insurance and private insurance via a Spanish-licensed insurance provider.

- Medical certificate: Original and photocopy, original translation, and photocopy of translation if required. This form must be released no later than 90 days before the appointment date, and it must contain letterhead as well as the original signature and/or stamp of a doctor (only M.D. or D.O.s will be accepted).

- Certified copy of your country of origin’s criminal record certificate for the previous five years. The certificate must have been given within the last 90 days before submitting your application and must be valid for three months from the date of issue. The certificate must be legalized by the Spanish Consulate/Embassy in the country if it is not Singapore.

Financial Guarantee:

For the next two years, the applicant must show a monthly income of €2.130 for the main applicant, plus an additional €532 for each dependent individual under his or her charge (each applicant’s family member applying for a residency visa).

To have a financial assurance or guarantee, the applicant must present the original and photocopy of the following documents: savings accounts/current account bank statements (up to 12 months) / bank deposits/ Your name as the account holder must appear on each document.

Documents Needed For Family Members:

This visa is for the applicant’s spouse, children under the age of 18, and children over the age of 18 who are objectively unable to care for themselves due to their health.

A marriage certificate is also required if your spouse applies. If the certificate is not issued in the United Arab Emirates, it must be legalized by the Spanish Consulate in the country of origin. If the certificate is written in a language other than English or Spanish, it must be translated into Spanish or English and approved by the Spanish Consulate in the country of origin.

If you are applying on behalf of your dependent children, birth certificates are required, along with the same credential requirements. In addition, all the documents mentioned above also apply to family members.

Spain Golden Visa For Real Estate Buyers and Capital Investors

For Real Estate Investment:

- A maximum of 90 days needs to have been passed after the property was acquired before the visa application was submitted.

- A property registry filing (certificate) or notarized deeds with evidence that they were filed with the property registry.

For Capital Investors:

These visas entail a minimum investment of 2 million euros in Spanish bonds, a minimum investment of 1 million euros in the purchase of Spanish company shares, or a minimum deposit of 1 million euros in Spanish banks. Before the application is submitted, the investment must be carried out for 60 days.

1) A certificate granted by the Registro de Inversiones Exteriores del Ministerio de Economia y Competitividad in the case of acquisition of shares in non-publicly traded firms

2) A certificate from a registered broker in the case of acquisitions of publicly traded companies

3) In the case of Spanish bonds, a certificate from a bank or the Bank of Spain confirming the investment for a minimum of five years

4) A bank certificate in the case of a bank deposit

Legalizing Documents

Any document issued by a government authority must be legalized with the Hague Apostille.

- Criminal record background checks

- Marriage certificates

- Birth certificates

- The nation or state where your document was released must apostille it. Each state’s secretary of state may issue an apostille in the United States.

You should have a two-page document until the background check is apostilled. The apostille will be on the first page, and the official letter from your background check will be on the second. For any cause, do not detach the papers.

All non-Spanish documents and certificates must be translated by a sworn Spanish translator accredited by the Spanish government. If the document is available in English or Spanish, no translation is needed.

Bank Account and NIE

Non-EU people normally obtain their NIE application along with their Spanish residency permit after submitting their Golden Visa application.

The Foreigner’s Identification Number, or tax identification number, is referred to in English as NIE, or Nombre de Identificación de Extranjero. When paying taxes, making official transactions, and engaging in other legal or official activities, the NIE number is most commonly used. It is used in all fiscal transactions with the Spanish tax authorities.

All foreigners with financial, technical or social affairs in Spain must have an NIE number. Even if you are not seeking permanent residency, it is a good idea to get an NIE number as soon as possible.

Spain Golden Visa Program Fees

The following fees are charged by the Spanish government for the Golden Visa program:

- €249.65 for citizens of the United States (tax inclusive)

- €179.79 for Canadian citizens (tax inclusive)

- €133.92 for all other nationalities

Legal fees for a family of four are usually around €9,000 for the initial application and €2,500 for each renewal.

Taxes in Spain

If you are living and working in Spain, you are liable to pay income taxes on your income and assets and will need to file a Spanish tax return. Whether you pay Spanish taxes on your worldwide income, or Spanish-based income only depends on your residency status.

If you’re a resident of Spain, you must pay Spanish tax on your worldwide income. Taxes apply on a progressive scale, although tax deductions exist. If you are a non-resident in Spain, you only pay tax in Spain on Spanish income, typically at a flat rate. This also includes potential income on Spanish property even if you don’t rent out your property. Spanish tax also applies to property ownership, investment interest, and goods and services in Spain.

Taxes in Spain are split between state and regional governments. This means that Spanish tax rates can vary across the country for income tax, property tax, wealth tax, capital gains tax, and inheritance tax in Spain.

Tax in Spain for non-residents

If you live in Spain for less than six months (183 days) in a calendar year, you are a non-resident and only pay taxes on the income from Spain. Taxes apply to your income at flat rates with no allowances or deductions. If you are a non-resident and own a property in Spain, whether or not you rent it out, you will need to submit a tax return and pay Spanish property taxes for non-residents (or imputed income tax on your property) as well as local Spanish property taxes.

Spanish tax rates in 2022

The following are the basic Spanish tax rates on employment income. Since tax rates in Spain are not uniform across the country, your total liable tax will be a calculation of the state’s general tax rates plus the relevant regional tax rates.

Spain’s tax rates in 2022 are as follows:

- Up to €12,450: 19%

- €12,450–€20,200: 24%

- €20,200–€35,200: 30%

- €35,200–€60,000: 37%

- €60,000–€300,000: 45%

- More than €300,000: 47%

Income tax on savings is levied at the following rates:

- 19% for the first €6,000 of taxable savings income

- 21% for the following €6,000–€50,000

- 23% for the following €50,000–€200,000

- 26% for any savings income even more than €200,000

Register to pay Spanish tax: residents and non-residents

You will need to register to pay tax in Spain with the Spanish tax authority, whether you are a resident or non-resident. First, you’ll need your Foreigner’s Identity Card (NIE) number, which you can get through the local Foreigner’s Office (Oficina de Extranjeros) or police station within 30 days of arrival in Spain.

Fill out Modelo 30 to register your obligation to pay Spanish tax as a resident or non-resident for the first time, or to change your details.

Filing your Spanish tax return

Everyone has to file a Spanish tax return in the first year of tax residency. After the first year, you don’t have to file a Spanish tax return if your income from all sources is less than €8,000 and you have less than €1,600 of bank interest or investment income. The same applies if your rental income is less than €1,000 or you earn less than €22,000 as an employee, as your Spanish income tax will have been deducted by your employer.

To make a Spanish income tax declaration, see Modelo 100. The tax year in Spain runs from 1 January to 31 December. Eligible residents must file tax returns between 6 April and 30 June of the year following the tax year. There are no extensions on filing tax returns in Spain.

You can find information on how to complete and submit your Spanish tax return, information on previous tax returns, and payments made. To access this service, you need your digital identification certificate.

Spanish taxes for non-residents

The general flat income tax rate for non-residents is 24%, or 19% if you are a citizen of a country in the European Union or the European Economic Area.

Other income is subject to Spanish non-resident taxes at the following rates:

- Capital gains resulting from transferred assets are taxed at a rate of 19%.

- Investment interest and dividends are taxed at 19%, although are typically lower through double taxation agreements. Interest tax is exempt for EU citizens.

- Royalties are taxed at 24%.

- Pensions are taxed at progressive rates, from 8% to 40%.

To apply to pay income tax as a non-resident of Spain, first obtain Modelo 149. Next, use the Modelo 150 form to make your income tax declaration. If you are a non-resident property owner, you should make your tax declaration on Modelo 210.

Spanish property tax

If you own a property in Spain and are living in it, on January 1 of any given year, you must pay a local property tax or Impuesto sobre Bienes Inmuebles (IBI). The amount is the rental value multiplied by a tax rate set by the local authorities. This applies to non-residents and residents. There is also basura, a rubbish collection tax. Non-resident property owners may also need to pay imputed income tax at flat rates on potential rental income on Spanish property.

If you sell a property in Spain, you have to pay a property transfer tax, Impuesto Transmisiones Patrimoniales (ITP). When a property is sold, the local authority charges a tax on the increase in the value of the land, the plus valia.

VAT (IVA) in Spain

Spain has three levels of value-added tax (VAT) or Impuesto sobre el Valor Añadido (IVA):

- General: 21% on goods and services

- Reducido: 10% on passenger transport, toll roads, amateur sporting events, exhibitions, health products, non-basic foods, rubbish collection, pest control, and wastewater treatment

- Superreducido: 4% on essential foods, medicine, books, and newspapers

In 2021, the government increased IVA from 10% to 21% on alcoholic drinks and beverages containing added natural and derived sweeteners and/or sweetening additives. The tax hike excluded baby milk and drinks considered as food supplements for special dietary needs.

All IVA payers (primarily freelancers) must submit all invoice data online within four days of the date of issuance, and no later than the 16th day of the month following its issuance.

Capital gains tax in Spain

Spain’s capital gains tax (the tax on profits from selling property or other investments) is as follows:

- First €6,000: 19%

- €6,000–€50,000: 21%

- €50,000–€200,000: 23%

- More than €200,000: 26%

If you bought a property before 1994, you may be liable to pay more tax than before as taper tax on capital gains tax has been abolished. You might be eligible for an exemption if you are over the age of 65 and selling your main home or if you are under 65 and selling your main home to buy another main home in Spain.

Spanish wealth tax

Wealth tax in Spain is payable on the value of your assets on December 31 each year. Assets valued at more than €10 million can be taxed up to 3.5%, though rates vary depending on which region you live in. Everyone has a standard €700,000 tax-free allowance, and homeowners are allowed a further €300,000 against the value of their main residence.

Looking to invest in a rental property in Spain? Please, get in touch!

We will connect you with a local broker and provide our full assistance in this process.